Sports Betting Merchant Account Guide: Payment Processing for Sportsbooks

Everything sportsbook operators need to know about securing reliable payment processing in the rapidly expanding US sports betting market.

Read MoreExpert insights, industry trends, and practical guides to help your high-risk business succeed in the evolving payment processing landscape.

Running a high-risk business means facing challenges that mainstream merchants never encounter. From navigating complex compliance requirements to managing elevated chargeback ratios, every decision impacts your ability to accept payments reliably. Our blog exists to give you the knowledge and strategies you need to overcome these obstacles.

We publish in-depth guides on topics that matter to high-risk merchants: how to reduce chargebacks without sacrificing customer experience, which payment gateway features actually protect your revenue, and what underwriters look for when reviewing your application. You'll find case studies from industries like CBD and hemp, nutraceuticals, and online gaming—real examples of how businesses secured stable processing after being declined elsewhere.

Whether you're launching a new venture or looking to optimize an established operation, these articles provide actionable insights you can implement immediately. From fraud prevention tactics to negotiating better processing rates, each post delivers practical value. Bookmark this page and check back regularly as we publish new content on regulatory changes, emerging payment technologies, and growth strategies for high-risk merchants.

Stay updated with the latest payment processing trends and market insights.

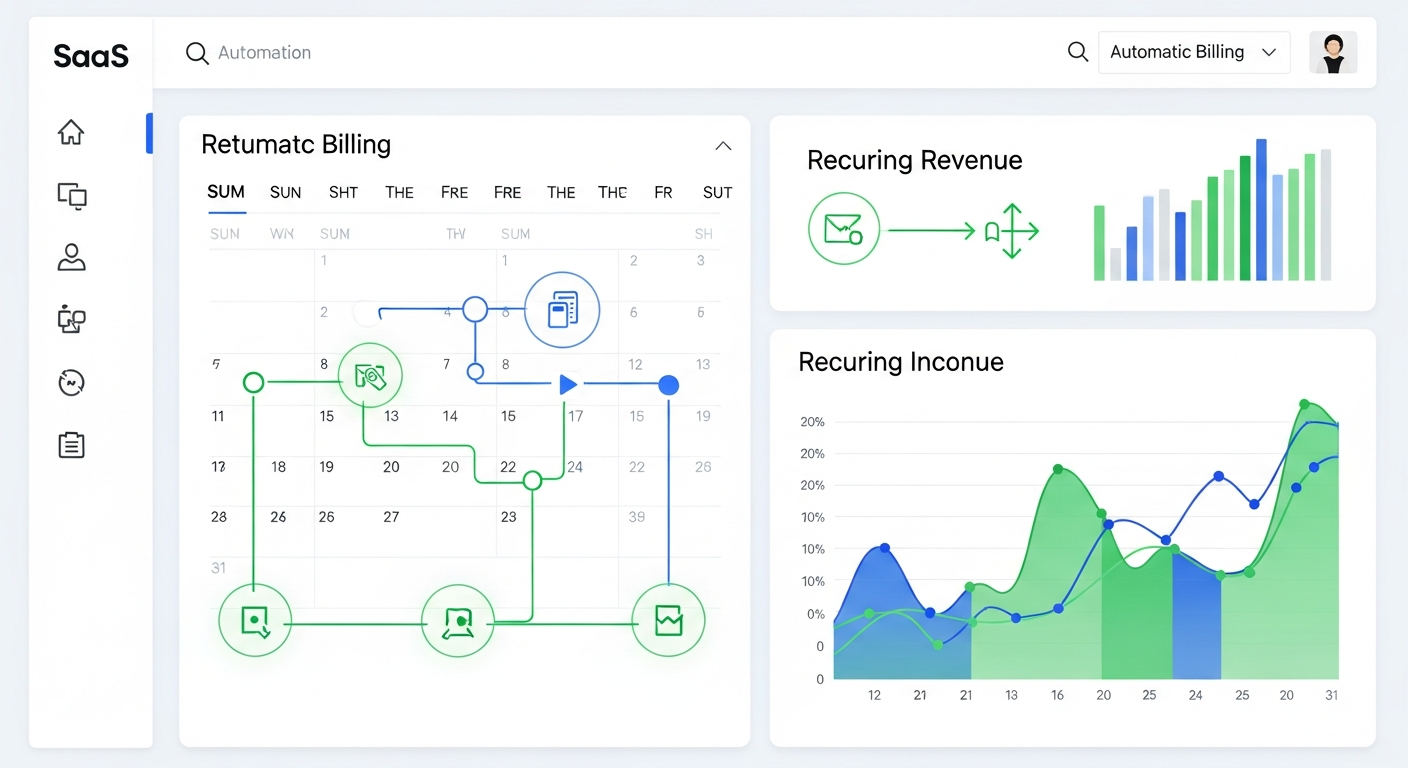

Learn proven strategies for optimizing your payment processing operations.

Discover how to scale your high-risk business with the right payment solutions.

Everything sportsbook operators need to know about securing reliable payment processing in the rapidly expanding US sports betting market.

Read More

Compare offshore and domestic payment processing options for online casinos—understand the trade-offs in fees, compliance, and player experience.

Read More

Proven strategies for reducing chargebacks in online gambling operations—protect your merchant account and maintain processor relationships.

Read More

Discover specialized payment processing solutions for anti-aging and longevity clinics offering peptide therapies like Sermorelin, CJC-1295, and Ipamorelin.

Read More

Learn the critical differences between research and therapeutic compounds and how classification affects your ability to accept payments.

Read More

How cryptocurrency is transforming online casino payments and what operators need to know about integrating Bitcoin, Ethereum, and other digital currencies.

Read More

Everything you need to know about securing a merchant account for your peptide business, from application requirements to compliance best practices.

Read More

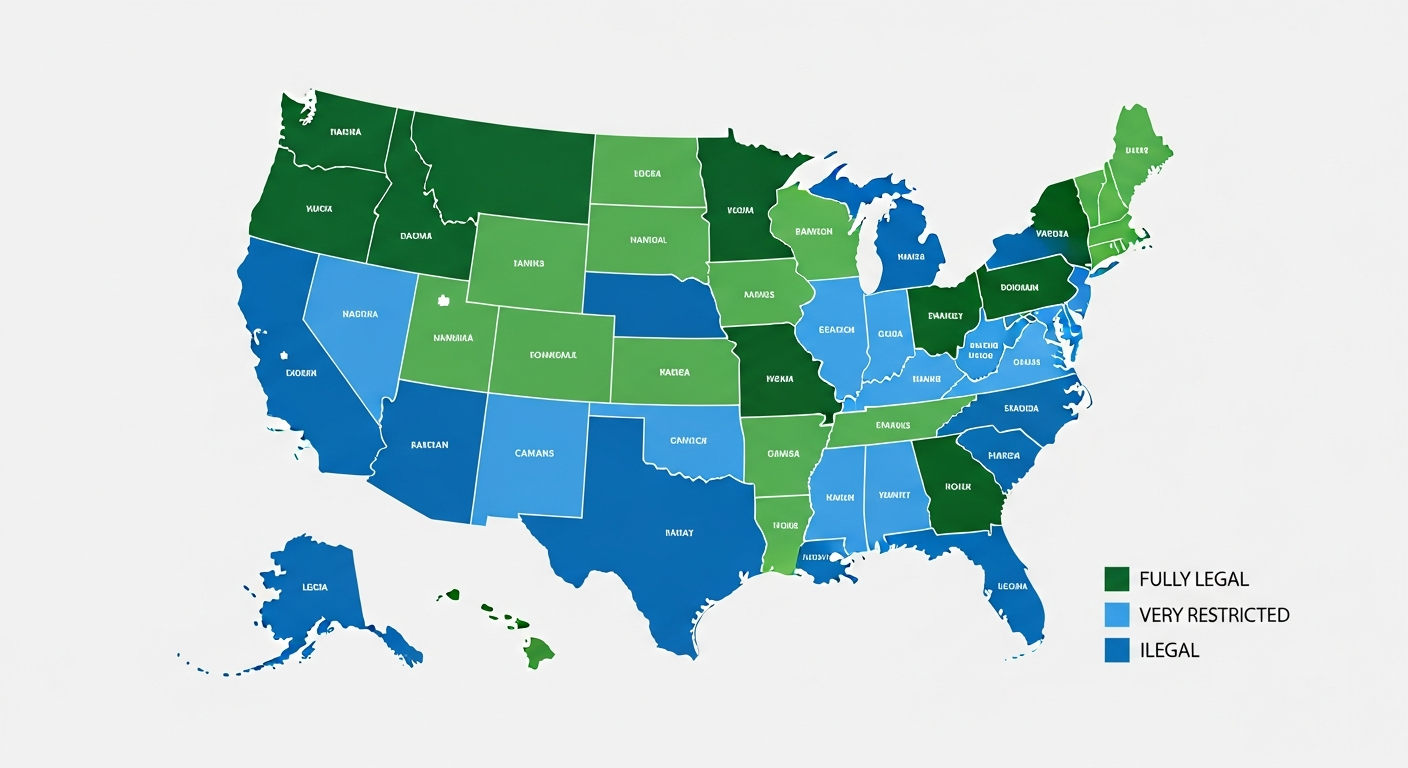

Navigate the complex patchwork of US online gambling laws and understand payment processing requirements for each legal state.

Read More

Master subscription billing management and chargeback prevention strategies for adult entertainment businesses.

Read More

Complete guide to documentation, compliance, and underwriting requirements for adult entertainment merchant accounts.

Read More

Understand the most common reasons adult entertainment businesses are declined for payment processing and how to overcome these obstacles.

Read More

A comprehensive guide to accepting credit card payments for BPC-157, TB-500, and other healing peptides. Learn how to get approved for a peptide merchant account.

Read More

Discover why peptide therapy clinics and research peptide suppliers struggle with payment processing, and learn proven strategies to secure a merchant account for your peptide business.

Read More

Comprehensive analysis of the high-risk payment processing industry in 2026. Discover key trends, market statistics, regulatory changes, and growth forecasts across 65+ high-risk sectors including CBD, gaming, travel, and more.

Read More

Step-by-step guide to getting approved for a high-risk merchant account in 2024. Learn what documents you need, how to apply, and secrets to fast approval.

Read More

Discover the real reasons traditional banks and payment processors reject high-risk businesses, and learn how to overcome these obstacles to secure reliable payment processing.

Read More

Learn proven strategies to reduce chargebacks by up to 70% in high-risk industries. Discover tools, best practices, and preventive measures that protect your merchant account.

Read MoreJoin thousands of high-risk businesses that trust HighRiskChamps for their payment processing needs.